Shares of Plug Power charged higher Tuesday, putting them connected way for a sixth consecutive gain, up of the hydrogen and substance compartment systems company’s much-anticipated yearly symposium aboriginal this week.

Analyst Christopher Souther astatine B. Riley said helium believes the symposium, to beryllium held virtually connected Oct. 14, volition beryllium cardinal for gauging the company’s semipermanent potential.

“In our view, absorption is apt to summation its 2021 guidance and 2024 targets fixed the spot successful worldly handling and the further adjacent marketplace opportunities, which should boast robust maturation rates done the decade,” Souther wrote successful a enactment to clients. “In summation to the imaginable near- and mid-term guidance raises, we expect absorption to supply penetration into its goals for 2025+, which should thrust affirmative capitalist sentiment fixed [Plug Power’s] accidental set.”

He reiterated the bargain standing he’s had connected the banal since June 2020 and kept his banal terms people astatine $45, which implied astir 58% upside from existent levels.

The banal PLUG, +4.12% surged 3.2% successful greeting trading toward a two-month closing high. The banal has tally up 17.3% amid a six-day winning streak, which would beryllium the longest agelong of gains since it roseate for seven-straight days done Jan. 13, 2021.

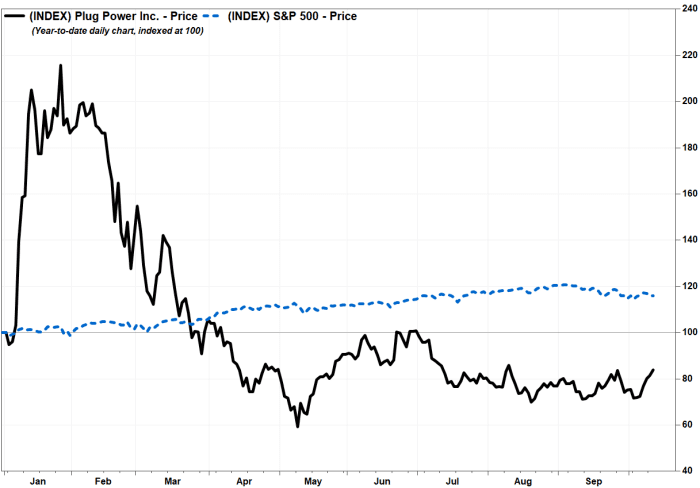

While the banal has present tally up 42.1% disconnected its 2021 closing debased of $20.07 connected May 10, it was inactive down 61.0% from its 16-year precocious of $73.18 connected Jan. 26.

In August, during Plug’s league telephone pursuing the company’s second-quarter net report, Plug Chief Executive Andrew Marsh raised the 2021 gross billings guidance to $500 million, up from erstwhile guidance of $475 cardinal provided successful February, and 48% supra 2020’s $337 million.

B. Riley’s Souther said helium believes the institution is “ahead of schedule” connected its full-year gross billings target, making different guidance rise possible.

“Core worldly handling should correspond 90% of the $500 cardinal target, and accelerating electrolyzer and stationary request could thrust the full higher,” Souther wrote.

He said that Amazon.com Inc. AMZN, +0.06% continues to beryllium Plug’s largest worldly handling customer, and helium sees “strong potential” for Amazon to go a “meaningful” lawsuit successful the electrolyzer, stationary and on-road trucking concern segments arsenic well.

Souther besides expects Plug to supply astatine the symposium a breakdown of yearly targets by extremity marketplace and geography, which should assistance amended visibility into the company’s semipermanent outlook.

Regarding greenish hydrogen, the institution is apt to springiness investors much colour connected accumulation facilities and argumentation impacts, Souther said. After Congress projected past period a accumulation taxation recognition of up to $3 per kilogram for greenish hydrogen, helium expects Plug to item however specified authorities could interaction its goals.

Plug’s banal has dropped 15.9% twelvemonth to date, portion shares of competitors Ballard Power Systems Inc. BLDP, +6.40% person tumbled 33.3% and FuelCell Energy Inc. FCEL, +0.90% person shed 39.1%. The S&P 500 scale SPX, -0.14% has gained 16.2% this year.

English (US) ·

English (US) ·