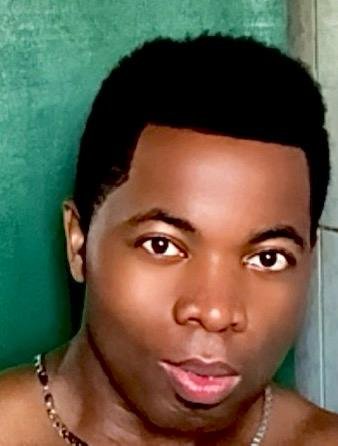

Jonathan Nzali | Asset Protection: Holding Company and an Operating Entity

How to use Holding Company to protect assets

Jonathan Nzali Eight out of ten entrepreneurs will fail within two years and 80/100 of the remaining ones will not make it up to 5 years. Those are the staggering statistics. If you are like the average entrepreneur, you invest an extreme amount of time, personal assets, friends’ assets, and money into doing the best you can so your plan will succeed. When things fall apart though, everyone is after anything left or anything you had. The following tips are designed to insulate you as much as possibly permissible by Law from potential liabilities from personal as well as business creditors whether you succeed or fail in some ways. Let us begin:

Using holding and operating companies is an asset protection planning strategy that helps to limit liability risks in your business structure. An ideal business structure consists of an operating entity that does not own any vulnerable assets and a holding entity that actually owns the business’s assets. With this structure, the small business owner can eliminate (or, at the very least, substantially limit) liability for both business debts and personal debts.

The limited liability company (LLC) and corporation emerge as the two best choices of all the types of organizational forms available to the small business owner, in terms of asset protection planning and limiting liability in your business structure to avoid losing your personal assets if your business runs into financial difficulties. In most cases, the LLC will be superior to the corporation for the small business owner–although estate planning and tax ramifications need to be carefully considered.

However, even when the business is formed as an LLC or corporation, the business owner still faces an asset protection dilemma. Although operating your business as an LLC or a corporation protects your personal assets from the reach of business creditors, your business assets are still vulnerable to those creditors. The business can still lose everything that it has–which can spell ruin for a small business owner.

Often it seems that protecting the owner’s assets against the claims of personal creditors and against the claims of business creditors are competing interests. Assets placed within the business form are vulnerable to the business’s creditors, but protected, to some extent anyway, from the owner’s personal creditors. However, assets kept outside of the business form are vulnerable to the owner’s personal creditors, but protected from the business’s creditors.

What's Your Reaction?